I have previously described my dislike for Philip Green, and I have also used the image of the valley above, but I have never combined the two until now. The result is not the finest piece of digital manipulation but neither is the subject matter. A fine bit of digital manipulation, that is.

Rents

There is a lot PG has to answer for the problems facing the Arcadia group, but there are other factors that are also affecting other major High Street multiple retailers here and abroad. The internet is one of course, but much has been said about that already . Rents, a singularly U.K. problem is common to both small and big retailers. I believe that the biggies actually have a bigger problem and a lot to answer for .They are part of the problem. If they had not been happy to pay the huge figures involved, during a more buoyant retail environment, and I suspect they were very happy, they would not have created a huge rod for their own back and that of their smaller colleagues. They knew how the landlords borrowing models were constructed and by subconsciously (maybe) funding this model they knew that it would be very difficult to reverse . The consequences have come home to roost.

Debt

Debt is how markets work. Without debt, the banking sector, would not exist . No banks no debt, no debt no business. Yet debt is good, bad, bad, good, good, bad there are no half measures. In my opinion it is was what an organisation does with its borrowings. Bad debt is another problem facing many of the big players. Some may say Arcadia’s problems have come about because of the way it has used its debt . That is to say huge dividend payments to the Green family, instead going to a major future investment programme ( ignoring any pension deficits) has left the group struggling. Another different example is that of Boots. They are having a tough time , the entire estate needs a massive investment in virtually every outlet because to me, they look tired and out of date. Yet part of the purchase of Boots by the giant American Walgreen saddled it with an additional £1 billion of debt. Now Boots having tough time, tired old shops, all it can do in the immediate future is close a load down especially where there are two or three in one town. What was that all about. The list is virtually endless Debenhams, House of Fraser and many others laden with debt, and the need to reinvent themselves without the means to do so.

Big Ships

For many years, multiple retailers seemed to think that the way of continuing success was to just open more stores without looking at why was that necessarily the right thing to do. When the sea got a bit rough they found that they did have the resources nor the time to turn these giant ships around before crashing into the rocks. Not only was and is there the question of long expensive leases but the huge costs in redeveloping the stores. The constant quest for ‘world’ or in this case U.K. dominance is more often than not, a cause for eventual failings within the retailers business model . We only have to look at Marks and Spencer’s and Tesco’s as perfect examples. Ironically both organisations sought to expand overseas which was when the problems in the U.K. started to come home to roost .They are not, of course, complete failures but they were both the ‘darlings’ of the High Street both now facing major structural issues. The biggest of ships have to go into dry dock for renovations, there is no dry dock for retailers they have to carry on trading . At the same time they seem to not look at what is going on over their shoulders until it is too late.

The Internet , debt, big ships and rents

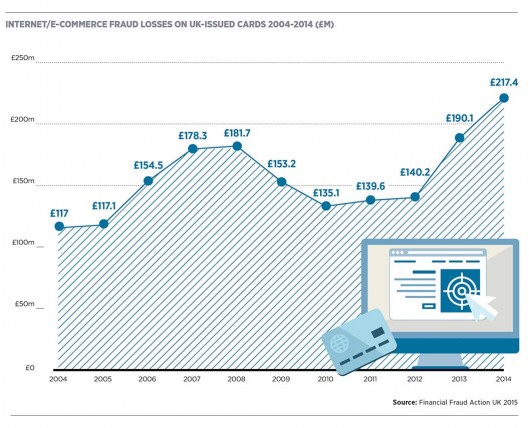

I said I would not go over old ground. So I will . The retailer cannot keep complaining about the internet. It has been there long enough . Best part of twenty years, if not a bit longer and it accounts for approximately 20% of total sales . Of course, if you take 20% off any one business it is a huge chunk . Yet there are still many successful High Street multiples eg Next, Uniqlo, Zara, Lidl, Aldi, JD Sports, Dunelm, The Entertainer (toys), and Lush. And the common factors are that they have rents to pay, business rates to pay and there is online competition. As to their debt levels this is slightly more complicated . For example JD Sports has increased theirs over the last 12 months and Dunelm has decreased. But both are considered to be in safe parameters as they generate plenty of cash to cover their relevant ratios. But they are succeeding within the same markets as those who are not. Which is how it has always been.

There was and is a danger of this becoming a bit wordy, convoluted and lacking in detail . Yet I am constantly frustrated at large retailers looking for excuses, when often the reasons are right in front of them, particularly when looking into a mirror. Moreover, their own mistakes, lack of foresight or commercial vanity impact on the small independents. I am not a financial analyst nor am I retail expert but as an interested observer I believe there are certain common factors that make a lot of valleys unsuitable to ‘greening up’ and in this case I mean that in a sense relating to green shoots et al, rather than a particular person who at one stage was hailed as the messiah of entrepreneurial retailing. The really unfortunate feature of this, is that those at the top of these valleys never suffer, at least not financially . Those at the bottom(employees and suppliers) invariably always do.