Yep, second time.

Those who know me will think ‘…who does he think he is, Bear Grylls? and most readers who don’t know me probably couldn’t give a toss, or I am making it up.

Well, my first time (Post May 2021) was in the Amazon, all dancing, all singing Hi Tec, no checkout store in East London. Very impressive but now closed down. Clearly it may have worked but was not making any money.

My second was a much bigger adventure. I had a tour of an Amazon warehouse.

I will have to start with the positives. Albeit not a difficult task as there were many pleasant surprises in store.

For those who have seen their social media posts, they have, for some time, been offering free tours at specific branches.

The first and probably the one factor that had the most impact on me was the quality of the Amazon Colleagues that led us around on the tour. The young female (early twenties- and yes it is relevant ), who was the spokesperson, had only worked there for four months. Yet she spoke, unscripted, without hesitation, and in an enthusiastic and entertaining manner. The only time she deferred to the two older women ( who had worked at this site since it first opened 10 years ago) to query something she did not know (which could only been three max four times) during the 90 minutes of the tour.

Part of the talk was about working for Amazon. Often being described in the past to being paid the bare minimum and under prison camp style management, it would either be much has changed or it was never thus.

Good starting wage rate, very flexible working options, private health care (including dentistry), excellent training possibilities, free Prime membership, 5 on-site canteens plus a video games room, plus continuos work place rotations (you could be your guide leader one month and then for the next month working in a different operational job within the site) in order that boredom does not set in and the development of diffrent skills within the business are only part of the package. I think what is on offer would put many major UK companies to shame. Proof (or at very least evidence) of the pudding was the two colleagues who had worked there for 10 years appeared very happy in their work

Technically, I was less surprised as I expected it to be high-tech and super efficient. And it was. What I didn’t realise was that nothing was shipped to the consumer directly; it all went to a hub and was shipped from there. Another extraordinary feature is that if a customer says they ordered 5 of an item and there are only 2 in this warehouse, then those 2 would be shipped to another warehouse that could complete their order, assuming they did not have the 5.

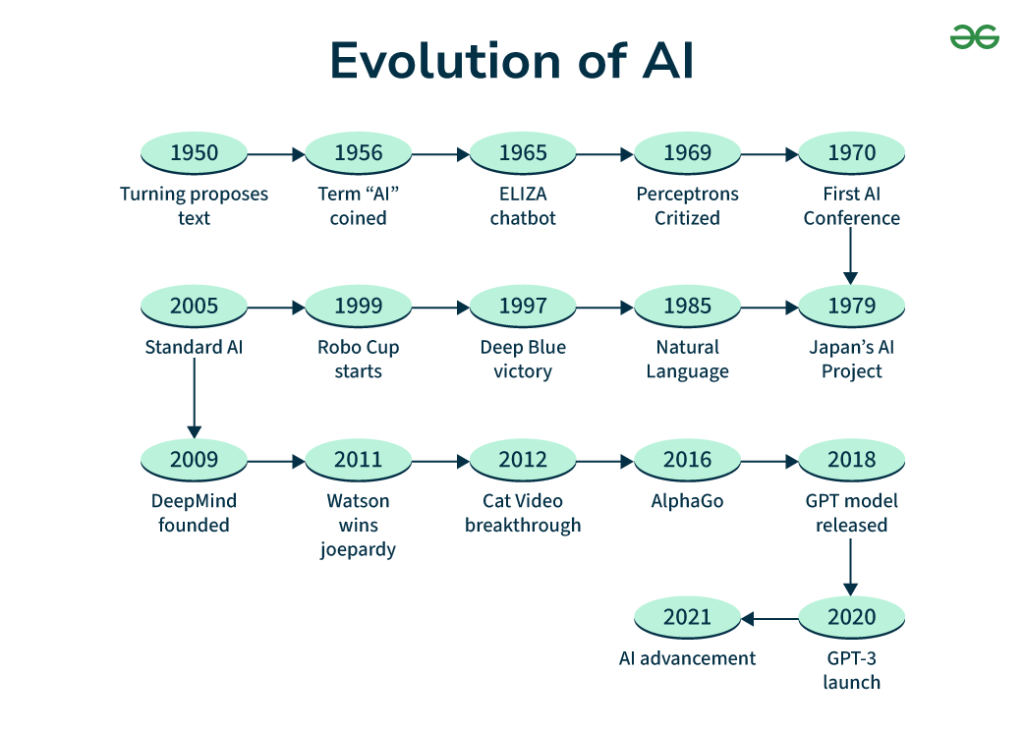

Robotics were, of course, prevalent, yet in some instances, they had been removed where human intervention was found to be more efficient. It is nice to know that occassionally us mere mortals still have some uses. I don’t think for one moment it is the company being ultra altruistic about the working population, especially as they are in the process of laying off 16,000 globally following 14,000 in October. Primary causation being AI (and yes the top cartoon image was AI-produced but I would not have employed anyone to create such an image. So I was not nicking anyone’s job.

The negatives are perhaps less well known to the consumer (apart from the paragraph above) as they relate more towards the Market Place Sellers. These are some the ‘feel good ‘ Amazon Stories (from Amazon, of course)…

But for every success story, there is a bucketload of failures. Which is, of course, the same with any business opportunity. In general, they don’t treat their sellers especially well. They are very inflexible, and there is no internal communication, even between Amazon colleagues. I am aware of 2 sellers who very recently had tens of thousands of products in Amazon warehouse blocked for several days during a critical seasonal period, and Amazon could not tell them why except ‘it was some sort of error’.

They constantly pursue genuine regular sellers of long standing with issues concerning conformity, descriptions, brand ownership issues, and at the same time ignoring flagrant breaches from random sellers in the depths of the likes of China. For a long time some sellers were using false VAT numbers, although that seems to have been sorted (but not entirely). As to why it took so long is anybody’s guess, as I have thought a very simple VAT number checker, within their software, would have sorted that overnight, instead of taking four to five years. They vigorously pursue bona fide sellers fro issues of product conformity yet ignore distant sellers flogging dubious prodcut from are from far flung sources which are quite clearly imitations of genuine product.

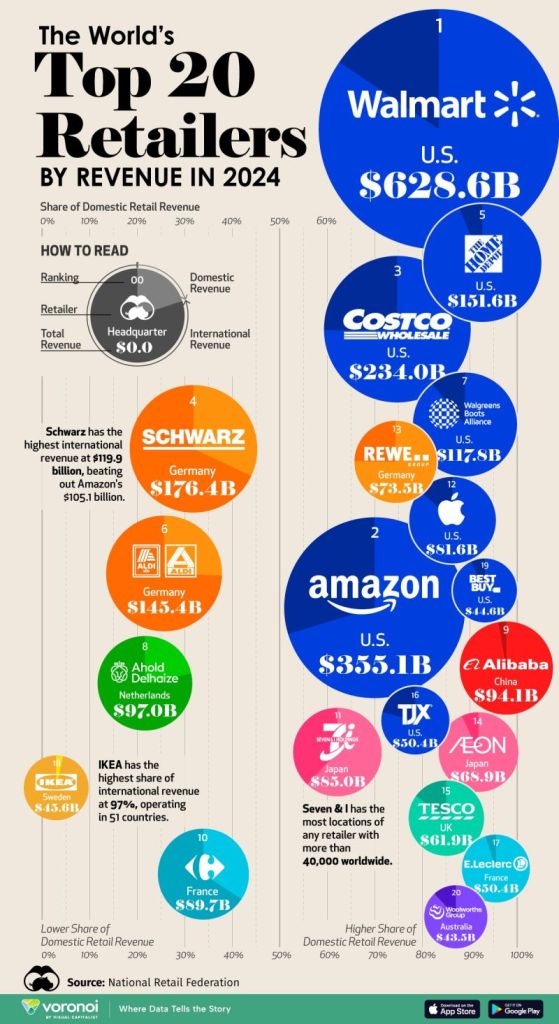

Yet they remain, virtually, unchallenged. There is, of course, Temu and Shein and there is a new boy, watch out for jd.com (joybuy.com). They are, for the most part, just nibbling at edges.

Under the partnership, CBBC will partner with JINGDONG Cross-border, JD.com, Inc.’s cross-border import business to support engagement with UK businesses. JINGDONG Cross-border will provide brands with market insights, operational support and access to JD.com’s comprehensive e-commerce and logistics capabilities, helping them reach Chinese consumers more efficiently and effectively.

During the forum, JD.com also confirmed its plan to officially launch Joybuy in March. The company is developing its online retail business, Joybuy, in the UK, to offer consumers a broad range of high-quality branded products, with fast delivery across the UK. The company is also investing to expand its UK warehousing network and delivery network, JoyExpress.

JD.com is ranked 44th on the Fortune Global 500 list and is China’s largest retailer by revenue. The company has been listed on NASDAQ since 2014, and on the Hong Kong Stock Exchange since 2020. Committed to the principles of customer first, innovation, dedication, ownership, gratitude, and integrity, the company’s mission is to make lives better through technology, striving to be the most trusted company in the world.

Leicester, UK – December 22, 2025 – JINGDONG Property, a leading infrastructure investment and asset management company and a part of JD.com, Inc., today announced the acquisition of a logistics property outside Leicester. The portfolio includes two ‘big-box’ warehouses with an area of over 231,000 sq ft (~21,500 sqm) and an adjacent ‘oven-ready’ greenfield site that can be developed into modern industrial and logistics space of up to 678,000 sq ft (~63,000 sqm).

JINGDONG Property’s entry into UK began in 2022 with the acquisition of a 361,000 sq ft (~33,500 sqm) warehouse in Milton Keynes. With this new acquisition, the total warehouse footprint in the UK of JINGDONG Property will be expanded to nearly ~340,000 sqm.

I think the reason Amazon remains head and shoulders above the rest is that they have nearly thirty years of traction and ensuring that the customer comes first. Until a serious competitor builds that same relationship with the consumer, Amazon will remain King of the Jungle. But nothing is forever.

Whatever, your involvement with Amazon, treat yourself to the Trip (if not a lifetime ) of a Daytime