Investigating a murder and making economic forecasts both involve data and analysis. Murders involve analysing historic data , whereas economists analyse some historic but more importantly look at data going forwards. Crime investigators know for certain there is a perpetrator, economic analysts know nothing for certain.

At the beginning of every year, once journalists, commentators, and various types of financial fortune tellers, have finished throwing ale and wine down their necks and gorging on rich food, regurgitate forecasts, premonitions, propositions and outlooks for the year, as if it was something new and we should all look up and take note.

One of the sources for this post happens to be The Times Newspaper (U.K.). As with every January of a respective year, they provide share tips for 2025. They were conscientious enough to summarise their 2024 tips. If you had followed their analysis in January 2024 and invested £10,000, you would have lost £3,000.

At the outset, 2025 does not look great. 2024, for the most part was not good and there is little to suggest there is going to be any change soon.

So what are these ‘glimmers’.

Surveys of private sector companies show 70 per cent of firms expect higher turnover in the first three months of 2025, compared with a year earlier, and are confident in Labour’s attempts to boost the competitiveness of the economy through its policy promises.

A monthly sentiment index from Lloyds, which surveys 1,200 companies, shows nearly three quarters of them expect higher profitability in 2025 and 70 per cent say that their turnover is also on course to grow, compared with 62 per cent a year ago.

Mehreen Khan, Economics Editor Sunday Times 29th December 2024

In a recent survey, by The Times, of fifty-one economists, the majority said there would be at least 4 interest rate reductions in 2025. Within the last two weeks that has changed to 1, in the last 24 hours it became 2. How the ‘eck do you plan?

April 2025 will bring an increase in the minimum wage . Theorically this will put some additonal cash into the pockets of the lower paid.

UK small businesses upbeat about 2025, KPMG finds

Despite economic uncertainty, 92% of SMEs are confident about the outlook for their companies over the coming year

A survey of 1,500 private business owners conducted by the Big Four accounting firm KPMG found that 92 per cent were confident about the outlook for their companies over the coming year.

With my focus being with the retail sector, that ‘glimmer‘ is somewhat ‘dimmer‘. It is still going to be tough both on the High Street and Online. The High Street is experiencing flat demand, rising costs, and they still believe online continues it’s world domination (back to that in a bit) . Online stores are burdened with increasing costs (very similar to bricks and mortar) increasing ‘unfair‘ competition from the likes of Temu, Shein and Alibaba. Unfair because the prices are often completely bonkers, the quality is sometimes poor but more importantly, they take advantage of extraordinary arcane shipping agreements which allow product to be shipped from China less than it would have been to send a Christmas card first class post in the UK. Much of the product has never been anywhere near a relevant product safety lab.

Back to that in a bit-Bit

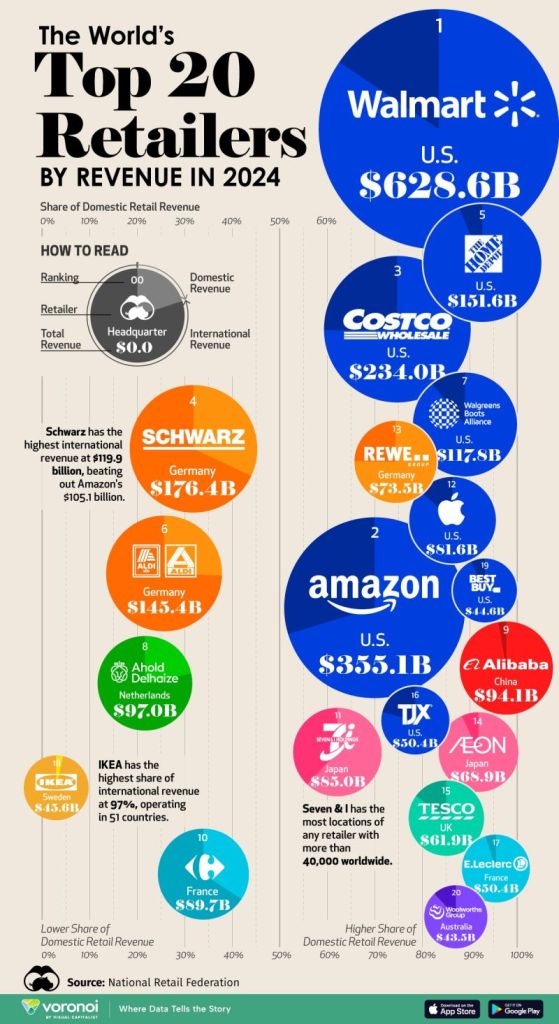

The image below displays the World’s top 20 Retailers. I think it is significant that the top 4 are Bricks and Mortar . Of course even these have signicant web sites but looking at the ratio of spend they would still be bigger than Amazon if you deducted their online ratio of approximately 20% .

- 266 million Americans (79%) shop online.

- Online shopping represents 20.1% of all retail sales worldwide as of 2024; in the U.S., online shopping represents 15.6% of retail revenue. Capital Shopping Research.

In the UK the figure is nearer 30%. However, the sinificant figure is that this has changed only marginally in recent years apart from during Covid , when it peaked but dropped back . I think the US figure of 79% shopping online only represents 15% of their total spend (as illustrated above).

There are many reasons as to why online purchases are not powering ahead. One is quite simply the high cost to market. It is no longer a cheap option to sell your product. Assuming you wish to make a profit. Service, convenience and availability have become priorities for web shops of all sizes. All these cost money.

Whilst many economies are seeing the ‘cost of living crisis’ as having a significant impact on consumer spend many are overlooking that consumers are also altering their behavior in terms of disposable income. Recently, Julia and I visited a Travel EXhibition (B2C). It was heaving . The exhibitors were not about Sun, Beach and Sangria. The majority were selling experience trips. We are in a period of ‘experiences ‘. Glastonbury 2025 sold out in forty minutes (best part of £80 million spend minimum ticket price £375). Oasis tour sold out immediately. Throughout 2024 all the major tours such as Taylor Swift were sold out. Take a peak at the recent Darts World Championship. Every night of a 3-week tournament was virtually sold out (and nearly every attendee wearing fancy dress!). Who would have put money on that ten years ago?

A phrase I would love to have claimed my own but unfortunately I have seen it elsewhere and that is we are in an ‘Experience Economy’. The consumer is spending their disposable income in a completely different way. For an industry such as ours (party) it is difficult to adapt, but not completely impossible.

Three, fairly traditional, companies selling what are fairly niche products and one which was selling via retail stores, something that everybody thought only had a digital future , have just posted amazing numbers for the last 12 months . Hornby, a very traditional UK toy train maker , having suffered a number of torrid years has reported an 8% increase in sales and a corresponding profit forecast. The Games Workshop, a product I would have also considered very niche and limited to a tiny proportion of the population is now in the UK FTSE 100, posting massive profits of over £125 million for the last 6 months of 2024. Finally, Waterstones, the UK’s largest bricks and mortar seller of books have quadrupled their profits in 2024.

All three of these companies sell products that come out of the consumers’ very discretional disposable income. All of which you would have thought would have suffered during a period of rising costs and reduced disposable spending. Whilst having only tenuous links to the party market, the key commonality is that of targeting discretionary consumer spend. These three have found answers.

To top it all, we now have a newly elected leader of the free world ….so does Glimmer become Dimmer and Dimmer becomes dummer? Let’s stick with Glimmer. The free world leader says these are Golden Times. ‘Let’s go get some gold’. Is that positive enough?

It has been difficult finishing this post. Every single day over the last 2 weeks, at least, the goalposts have changed. One day the glimmer gets brighter, the following it gets dimmer. Inflation is steady, then it is not. Interest will come down, no they won’t, and yes they will. There is no growth, sorry there is a bit, oh we can see there will be a bit more? House prices are going up and down. How can anyone plan?

Murder detectives collect evidence. New evidence may appear and change the outcome. But that evidence is historical evidence. Those running businesses, and planning economies have and always have nothing really better than informed guesses based on historical data and what current data suggest may happen in the future. Currently, that informed bit is very unreliable and constantly changing. So is the data. The one common factor among Retailers of all types, and this is true for products and services, Success cannot be achieved without stock. The key is, then making it is the right to stock at the right price.