It has always been a mystery as to why the UK (and Eire) market for Party never matches up to that of toys?

Without paying a heap of dough for some very dubious market research, there is no real indication of what the size of the Party Market is. Why doubtful, when I haven’t commissioned or read one (well, at least not for many years)? The beginning of a report by a company called Global Data, should wave red flags at anyone who knows anything about the U.K. retail Party market.

Over two-fifths of consumers bought partyware items in the last 12 months, up on (says who) 2024.

Birthdays (wow- that is extraordinary) are the key occasion for partyware purchases, followed by festive parties.

The first point is complete and utter tosh. Apart from perhaps balloons, there would be no question (and I think this is true of all Europe ), there has been a decrease in consumer purchases of partyware, most especially, Partyware disposables.

As far as the second point, would you pay for research that told you Birthdays are a key occasion for partyware purchases?

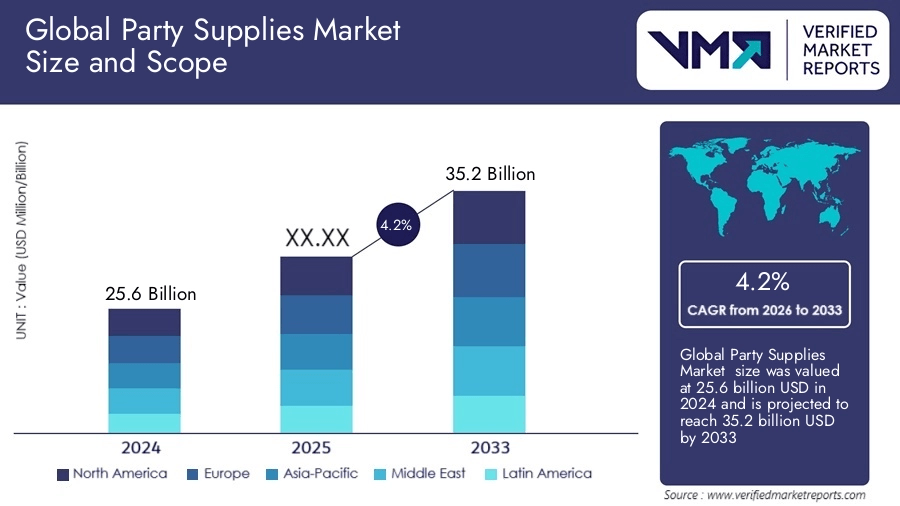

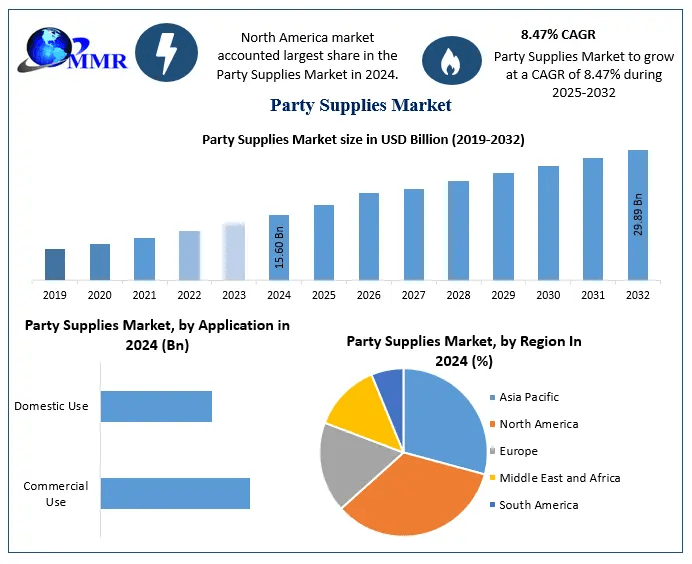

As for the chart, well, that is about as believable as the next one. There is clearly no corroboration.

The United Kingdom Party Supplies Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 7.06% in 2027, following an initial rate of 5.89%, before easing to 2.42% at the end of the period. (6W Research)

There would be a lot of players in the UK marketplace who would be delighted if they thought this was possible.

I know there is a lot more systematic collation of statistics within the UK Toy market. For 2024 it was estimated at just over £4 billion (Kasia Davies- Non food specialist researcher of Statista Jan 2025).

Consequently, one can be very confident that the Toy market is much larger than that of the Party Market. I have always found this to be slightly puzzling if only for one very simple reason. The Toy Market (excepting Games) is limited to a small age group within any population and very much focused on the Christmas period (UK), with birthdays coming in a distant (I think) second place. Whereas Party encompasses the entire population as potential customers. It has its peak, that is Halloween (Carnival in parts of Europe), yet virtually every other celebratory event can involve party products of some form or other.

In 1981 in Amersham(UK) Catherine and Gary Grant established The Entertainer, an independent Toy Retailer. Today, 2025, there are now 166 branches, in addition to potentially 2000 (by the end of 2025) further toy sections within the Tesco Supermarket chain. This is despite the downfall of UK Independent toy stores during that time and the rise and fall of Toys R US. There is more. Smyths is an Irish operation with 21 superstores in Eire and over 130 more in the UK with a further 150 throughout Europe.

Party, as Sinéad O’Connor once sang Nothing Compares….To Party (no, she didn’t sing that).

The largest chain in Party was 40 stores operated by The Greeting Card Retailer called Birthdays . The Stores were called Pure Party . They lasted about 7-8 years, closing down in about 2009 when struggling Birthdays was sold to Clintons, who eventually went bust themselves. Prior to that was the American Franchise Partyland who maxed out at 12. Whilst they have flourished elsewhere, they were doomed in the UK . For a short while, there was a small chain of 10-12 stores called Party Magic, between 2013/16. They, eventually, went the same way.

There are some very key differences in selling Toys and Party in a Retail store environment.

- A consumer generally knows what to look for in a Toy Store. In a Party store, they don’t. They need a lot more attention. If they don’t get it(attention ie good knowledgeable customer service) in a Party Store, the likelihood is that they will walk out without buying (as thye don’t know what they want)or certainly they will buy less. With Toys, they will walk in looking for Lego(other brands are available) pick it up, and take it to the counter. This may be an oversimplification, but if you want to create a twenties theme party, the customer , more often than not, need guidance as to what that may involve.

- Whilst margins may be lower in the Toy Industry, the average retail price point will be higher, consequently the individual cash take will be higher. Again, a generalization as I have been in a Party retailer and seen a consumer spend £800 on a first birthday party. But it also took the Store owner over an hour and half to serve this customer. Furthermore, it was going to take the store owner several hours over a weekend to set up the products on location (balloons in particular).

- Brands play a more significant role in the Toy Market. The Toy retailer will benefit from major consumer marketing activities. Within the Party Market, this is virtually non-existent. Party Brands only play a part in the distribution chain. The consumer will have very little awareness of any of the Major Party Brands.

As the Research correctly shows, the largest Party retailers in the UK are the likes of Tescos and Card Factory. Yet this is very deceiving as they are not Party Retailers. They are big by dint of having a huge number of stores and selling, in particular, a very large number of balloons. The UK Supermarket Chain Morrisons tried incorporating a Party stand-alone within stores, but it never worked (so did Matalan some years beforehand). I have no idea why they even tried; undoubtedly, they were convinced by some dubious data given by the supplier (who incidentally no longer exists, which tells a story). There was no level of service, and it was never going to generate the level of revenue per square foot that a supermarket demands of its space.

I stand on the Cliffs of Dover and look over the Channel in wonder. There are many chains throughout Europe, most especially France.

Fete Sensation- France -20 stores of which there are 12 around Paris

Jour de Fete- France & Belgium – 70 Stores

Buttericks – Sweden – 7 Stores (Established since 1903)

A UK Party Store- A bit of an exaggeration, but some like this still exist

So, what is the issue within the UK? There are underlining commercial differences. Whilst rents and local taxes tend to be lower outside the big cities, especially France, the cost to employ is very similar. France is probably higher because of their shorter working week, longer holidays and a much lower retirement age. The minimum wage is slightly lower than in the UK, but the labor laws are much more complex.

In-store ranges differ. For example, I have seen from the French party stores that I have visited, there is a lot more table decoration, disposable tableware, and, in some cases, floral decoration. Buttericks in Sweden are known for their Jokes and tricks. UK stores generally have a much more party-specific range. There are exceptions. Joke shops have Jokes! Various unclassified stores selling a range of products such as Cannabis Paraphernalia, smokers’ requisites (another quaint term), Goth products, alternative costume jewelry, and probably Steampunk. Last but not least is Party. A heady mix or just a place to get your head mixed up, nevertheless, they are called Head Shops!

Considering the number of good Party stores, whose proprietors would like to retire if they could sell their businesses ( bit of a struggle). It would be easy to think that the days of the Party retailer (High St) are doomed. I firmly believe that within a few years, there will be a new breed of retail entrepreneurs who will see that the market is underserved and will invest in new stores with a much updated view of retailing and make them Retail Destinations, which is what they need to be . Fun places to go, and most importantly, it’s about the concept of enjoying yourself in a party environment, and the consumer enjoying the experience of spending their money. Some of the UK Halloween pop-up shops have understood this. They have made their store a place to seek out and when they are there, get immersed into the atmosphere, and then most don’t mind spending a ‘few bob‘. As some retailers ( not many) are starting to understand that The Party is a great opportunity for social media and creating a ‘retail experience’

None of this has been helped by major issues with the unfortunate(or otherwise) misfortunes of some major worldwide suppliers. But the party market has a history of re-inventing itself, and I have no doubt this will happen again, but not just yet.

A tip for anybody thinking about don’t let AI create your Store design …..or maybe (beats the hell out of Lets Get Fancy dressed )