Retail Stock Maximization

Oh yes it is .

The British corner shop is experiencing a post-pandemic resurgence, with nearly a quarter of consumers relying on them more than any retailer, claims new research from Coca-Cola.

A survey commissioned by the soft drinks giant found that 23% of Brits are more dependent on corner shops than other types of retailers, while 34% said since the pandemic, corner shops are an “essential part of daily life”. The Grocery Gazette April 2025.

It came as a bit of a surprise to me. But then I thought about it, and it was less of a surprise. Covid, Working from Home, and a new generation (both owner and customer) have breathed a new life into this sector of retail.

I have seen the Corner Shop go through a whole gamut of changes. From the near and feared complete demise of the newsagent/cornershop in the late 1970’s early 1980s, when restrictive practices were eased on the distribution of Newspapers, and the Supermarkets started selling them. It was the local independent’s USP, and they lost it. Through to the 21st century version stuffed full of stock, open all hours, and a smile on their face.

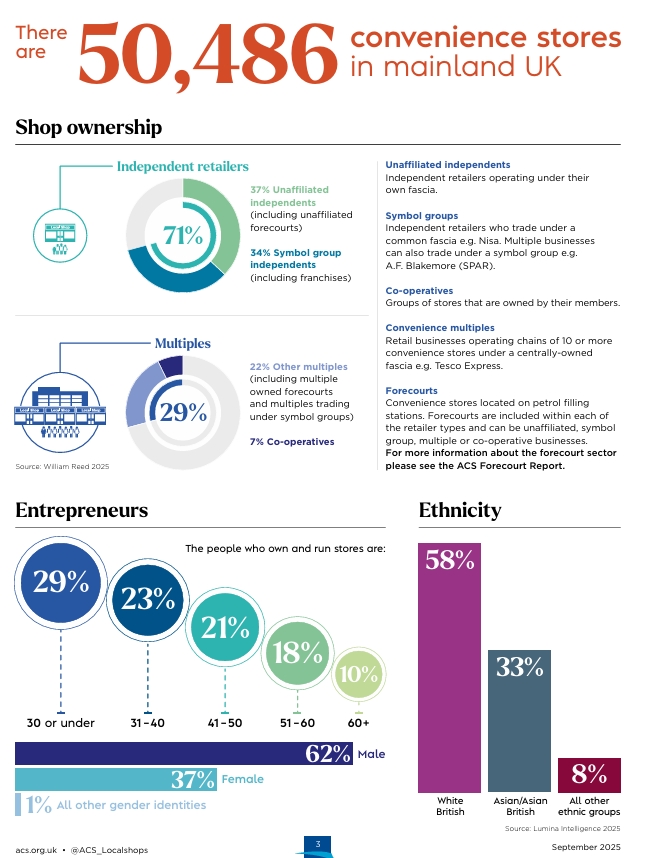

However, there was a cultural change in the early 1980’s that probably saved the UK Corner shop. Immigration from areas such as East Africa introduced a new type of retail entrepreneur who saw opportunities for creating and developing a business within a community. By the end of the 1980’s 50% of independent corner shops owners were of Asian Origin. They were prepared to work much longer hours and where relevant seven days a week . Today some of the UK’s wealthiest families started with one small shop in the 1980’s.

I started to notice a change several years ago not in Mainland UK, but in the Republic of Ireland. Frequently travelling around the countryside, I would go into Convenience Stores to buy a drink and a sandwich. It was very noticeable how different they looked against the UK equivalents. Organised, very professional looking and well ranged, were my initial thoughts. In more recent years this crossed the Irish Sea. Not in exactly the same way , as I am not so sure that many have replicated the smart look of the Irish stores. What they have done is squeezed pints into half pint glasses. I have a number of corner/convenience stores in my locality and the range of stock they carry is quite extraordinary. Compared to local Convenience stores operated by major supermarkets, they are invariably half the size but carry probably twice the variety of product.

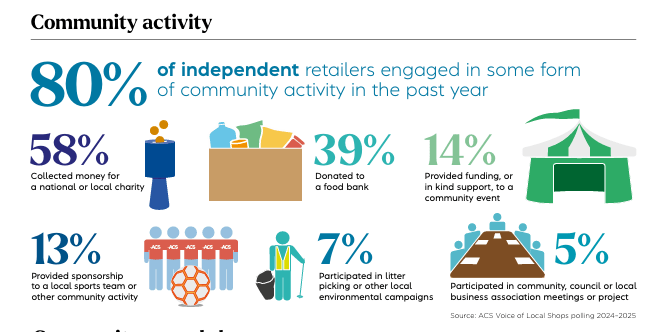

Clearly, it is not just about choice. As most are staffed by the owner(s), there is an additional level of service and community feel, long opening hours and the flexibility to meet local needs.

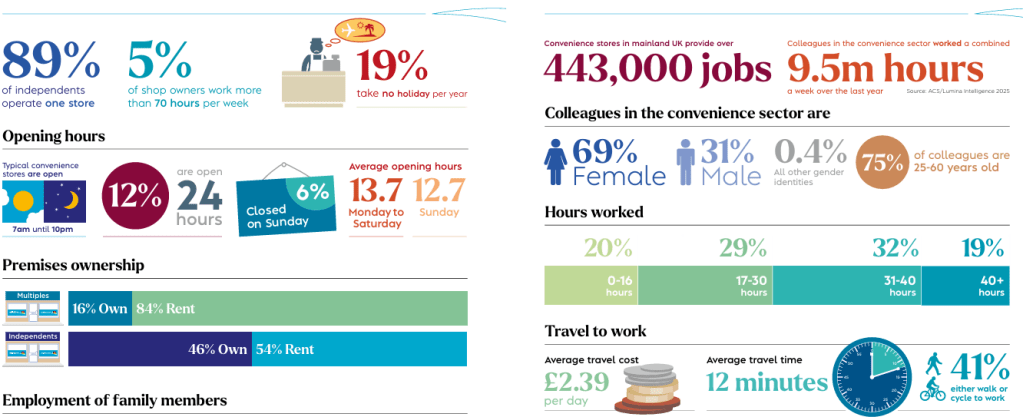

The UK’s 50,000 local shops play an

essential role in the lives of millions of

customers every day, not just through

a diverse range of products, but as

social hubs, community advocates

and service providers. Convenience

stores are also major contributors to

the UK economy, generating almost

£49bn in turnover, providing flexible

local employment for over 443,000

people and investing in excess of

£900m over the last year. (Association of Convenience Stores-UK)

What is quite striking about the above chart is that the largest age group of entrepreneurs is the under 30 Age Group. This statistic alone is very positive , as historically, I suspect that figure would have been a lot lower. Most certainly that would be the perception.

Digging a little deeper, that revenue is fractionally down on the previous year (approximately 2%); however, these are the stats of the ACS (as above), and not all independents are members of this Association. It is also important to underline the fact that the vast majority of these retailers are grocery-based. For me, this makes these numbers even more impressive as their competition are all ‘Big Guns’. The membership of ACS includes Post Offices and Pharmacies.

I am in danger of overloading this with 3rd party diagrams (all courtesy of ACS Local Shop Report 2025), but I am still going to do it as I think they throw up some interesting stuff.

There done it .

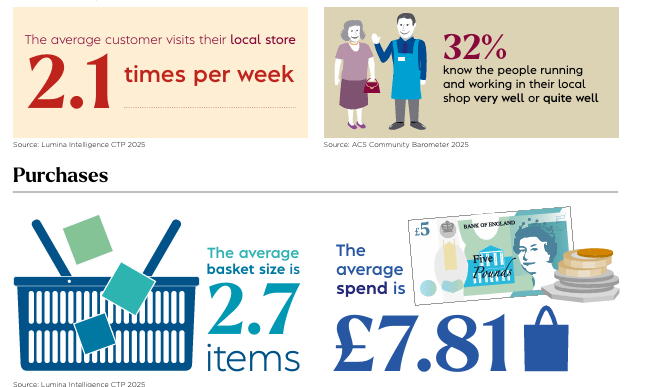

Of course, not all of it is ‘Wine & Roses’. There are major issues facing all UK retailers. With all the increased cost pressures on Retail Businesses, the last diagram illustrates the average basket size and spend. Neither of which look great.

With an average spend under £8 it is going to be tough to make any money. They are clearly not selling many packs of fags (average UK price of 20 king size=£16.60 –ONS Jan 25 ). A good thing for the Nations Health but not for the Retailer’s till! Even with a hefty margin, it is not easy making any money from an average take of £8 even if it is only 3 items. Yet if that customer visits the shop twice a week, as per the stats that equates to £800 per year per customer. The total average turnover is just under £1 million. The average net margin in Grocery is under 2%. However, this includes the multiples and does not include non-foods. Clearly there is going to be a huge variety in the Independent sector with both turnover and margin.

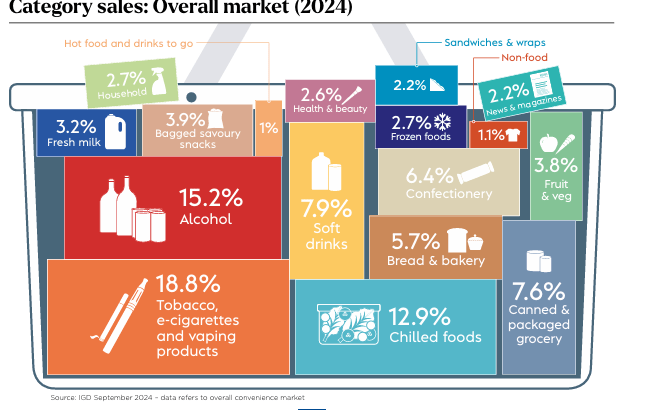

The diagram above indicates that from a point of view of margin, there are areas that have reasonable margins but are not especially well represented in the shop profile. The one that sticks out is the tobacco and vapes. Being the largest percentage, you would expect to see it in the average take. But then I have never been a retailer!

Yes, it is tough for all retail, yet there is some comfort in seeing an area of retail that twenty-five years ago seemed doomed actually growing. More importantly, much to my surprise, attracting a younger generation to participate. This is a generation that, for the most part, grew up with the explosion of the internet and experienced the birth of online shopping.

Footnote

Having looked through loads of different types of research and reports over the years, the Association of Convenience Stores should receive a round of applause for the quality of their reports. I cannot attest to the quality of data but with access to such a large membership, it has to be pretty reliable. It is the presentation that stands out. Research and Reports are created every minute of the day, everywhere in the world by a vast variety of ‘expert‘ organisations. So many are jammed full of useful data and analytics but they are often hidden by either complex jargon or unnecessary padding. In a market where the hours are long ( small independents) there is neither the time nor the desire to digest the relevant information. if bundled into dreary and forbidding reports. The ACS seems to have got it right.