- 5.25% Current UK Bank rate (August 2023)

- 7.9% UK inflation rate (June 2023)

- 2.9% drop in house prices in the UK (July 22 -July 23)

- 2.25 % Bank of England May 2022 forecast for Bank Rate May 2023

- 96% of GDP to 267% in 50 years’ time in 2071/72 (UK Office Office of Budget Responsibility)Net debt as a share of GDP rising – When has any UK Government- probably includes any western democracy- been interested in anything longer than the next General election

- $300 trillion Global debt(December 2022 -World Economic Forum) (US accounts for just over 10%)

- £0.70p average price of a pint of milk in the UK August 2023 (Office of National Statistics)

- 1.5% increase in UK Retail sales July 2023

- 1.9% increase in UK Retail footfall (same period)

- 3 in November -The age of our Dog Ari

- 384 – BC the year Aristotle was born

- 7000 – the number of trade prices I am supposed to remember (or so think some of my customers)

- 5.6 million -number Airbnb listings worldwide

- 7.9 billion -world population 2023

- 2.3 million US properties underwent foreclosure during the Sub Prime market in the USA between 2007 & 2008

- -4.1% (note this is a minus figure) China’s deflation figure August 2023

- 47.8% Turkish inflation rate – July 2023

- 64 million- number of shipping containers world wide

- 29 million beef cattle in the US in 2023

- 20 million penguins on Antartica

- 392,000 hotel rooms in Spain

- £84 billion -valuation of Pinduoduo ( owner of Temu latest Chinese market place)

- 9 million downloads of above Temu app in the U.K. , since launch in the U.K. four months ago (August 2023)

- 91 indictments faced by Donald Trump

- 3-1 the odds on Trump winning Presidential election in 2024

The point being….. We are bombarded by numbers every single minute of the day . Most we ignore but most are actually interrelated, and in some way effect all of us either personally, socially or in our working day. All of the above (with maybe the exception of the name of our dog) are interconnected in some way or another . Its a bit like the Chaos Theory of the butterfly that flaps its wings in Tokyo and ends up with a huge storm in the Mediterranean. This may not be an exact hypothesis but hopefully it gives as a reasonable picture as any Mathematical Theory does.

What we have to do is try to unravel those numbers that come to us and we think have an influence on our own businesses .

Unravelling is not an easy task, apart from anything many of those relevant numbers change . Only this week the UK HMRC stated that the tax take for first half of the year was higher than expected . Thus making the public purse look healthier . How so ? Everyone, whether companies, employed or self employed or retired and receiving unearned income, has to make a tax return. That Return determines how much tax is due . So where does all these unexpected tax come from ? Some shady deals where some weird taxpayers want to overpay their tax ? Me think not .

All of a sudden underlying inflation in the UK is dropping quicker than expected , when only last month we were being told it was very stubborn. So if the number makers cant get it right what chance have the rest of us.

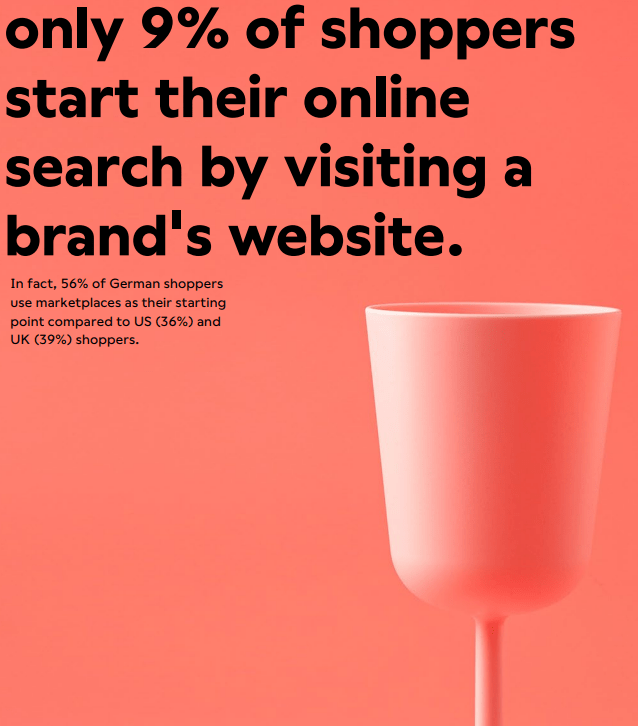

My view of numbers is to look at your own. That is is to say if your operation and your customer base is still spending make sure it continues . By that I mean there are many retailers who look at the numbers (cost of living, inflation, media reports ) and think ‘must batten down the hatches‘. This usually involves buying no stock . So as they have no stock , they sell less and are proved right and buy even less. Look at what is happening around you, not what others are telling is happening elsewhere.

Consumer confidence jumped five points to minus 25 this month , beating analysts’ expectations and up from 30 points in the previous month, according to the research firm GfK, which has been tracking the data since the 1970s.

An improvement in expectations for personal finances over the coming year and better predictions on how the UK economy will perform pulled the overall index higher.

The August confidence bump indicates households were growing more optimistic over the summer before a recent string of downbeat economic data renewed concerns about the UK slipping into recession.

The Times August 25/08/2023

Vs

The net balance of retail sales in August tumbled to minus 44 per cent, down sharply from minus 25 per cent in July. It was the biggest drop in sales since March 2021, according to the latest CBI distributive trades survey.

The Times August 25/08/2023

Same Newspaper , Same day (they were actually on opposite pages ) 2 very different sets of numbers .

Many a good retailer has told me that an empty hook doesn’t pay your rent . If you can only fill it with product that nets you a penny . That penny is better than nothing . If a customer walks into a store and there is nothing to buy, then that is exactly what will happen. They will buy nothing . But they will go elsewhere and buy that something. I experience empty shelves or hooks virtually everyday . Every empty shelf or empty hook= Potential Lost business and customer.

The media is stuffed full of numbers and most have some form of veracity or at very least they have at a point in time and place. But Context is the critical consideration . How do they relate to my business ? More importantly how do we react to those that are relevant .

If your business is not doing well, it is too easy just to blame it on the cost of living crisis, inflation, or the economic situation . Any one, or all, of those may indeed be the reason but those are not in your control . You can’t effect any of those . There maybe other factors either local conditions or something within your operation that you can affect. If your business is doing well , the very same things apply , but look at why you are doing well and don’t let the negatives alter your course unless there are very direct or obvious reasons for doing so.

Don’t let the Number Encumber ….