Broken to Buzzing

The High Street is a constantly evolving scene—it always has been and always will be. Current insanities aside, there are some surprises—or at least they are to me.

Before, during, and immediately after COVID, two particular chains were performing well and for good reason. Each very different in how they traded and where they traded. The estate of one was focused on trading from Retail Parks, and the other mainly, but not entirely, on High Streets. Hobbycraft is the former and Poundland, the latter.

Why they are struggling is not immediately obvious. Hobbycraft, from Day 1 had tapped into the burgeoning market of exactly what it says on the front door – Hobbies & Crafting. Poundland was very clear in its message on the front door – Everything is a £1. There was always going to come a point when this was not possible. Yet, they were always known for being a well layed out, professional discounter offering great value for money. In my opinion this started to change when the Pepco influence became prominent and the offering was very confusing. Added to which, the buying philosophy became a lot more detached from the potential supply base. Something I experienced with both.

But these are only two retailers. Recent Retailing history is littered by poor performing retailers. Some are still here many are not .

There are many reasons for underperforming retail activity, but there are also many reasons to think that all is not lost.

Just under 7 million sq ft of retail space was leased across the U.K. between January and March 2025. The figure represents an 8% increase on the previous quarter and a 25% increase on the same quarter last year. Marking the strongest leasing activity in six years. Isabella Fish, The Times 23 April 2025

Retail sales in the UK rose by 0.4% month-over-month in March 2025, defying forecasts of a 0.4% decline, following a downwardly revised 0.7% increase in the previous month. Sales in non-food stores increased by 1.7%, reaching its highest level since March 2022. Clothing stores saw the strongest growth (+3.7%), with retailers attributing the boost to favorable weather. Other non-food stores also saw a gain (+2.4%), particularly in second-hand goods stores and retailers selling garden supplies. Meanwhile, food store sales declined by 1.3%. Excluding fuel, retail sales grew by 0.5% from a month earlier. On a yearly basis, retail sales climbed 2.6%, exceeding forecasts and February’s 1.8% increase. For the first quarter, retail trade rose by 1.6%, marking the largest three-month increase since July 2021. Office for National Statistics.

Various U.K New Store Openings 2025

- Co-op 75 Stores

- Sainsburys 20 New Superstores, 25 Shop Local Stores

- Jo Malone 37-45 stores

- Waterstones 12+ (10 years ago, everyone said bookshops were dead)

- Holland & Barrett 50+

- The Entertainer ( Toy Stores ) will increase their exposure within Tesco Stores from 850 to 2000+ during 2025

- This link will show expansion plans by various players within the fashion industry https://www.drapersonline.com/news/whos-opening-stores-in-2025

- Virgin has recently announced that they are looking to return to Central London with a Virgin Megastore

Clearly, bricks-and-mortar stores are not yet a thing of the past. Understanding that the High Street remains a significant location to operate from, IKEA is opening 5 more of their smaller concept stores in Town centres during 2025. Their brand new store on London’s Oxford St was an investment just shy of £500 million.

The impact and future of Online shopping can never be ignored. Yet the very recent experience of Marks & Spencer’s, being hacked not only affected their Logistics but completely shut down their online operation. Underlying the importance to all retailers of having a presence in both camps.

It is not all about the Big Players ….

Key findings from the 2025 Rural Shop Report include:

· Rural shops provide secure, flexible jobs for over 178,000 people

· 40% of rural shops are the only convenience store in rural areas, with no other shops or businesses nearby

· Rural shops generated £18.5bn in sales last year

· Rural retailers have invested over £240m in their businesses over the last year to better serve their communities

There are 19,000 Rural Convenience Stores .

Whether a High Street is Broken or Buzzing is heavily dependent on the health of the town centre. There is an argument to say that the Health of the Town Centre is also dependent on the health of its retailers. It is a bit of a no-brainer to say if the Town is healthy and prosperous, it will encourage good retailers. The reverse is also true, where the Town can become prosperous but is not served by a good retail offering, the consumer will go elsewhere. There is a symbiotic relationship between the two. However, it does not always work. I can think of a number of UK towns that are quite affluent but they do not have a good retail offering. I cannot think of any example of a depressed town having a good retail offering.

Without question, there is a large chunk of consumers who do not have spare cash to flash . There are, however, a sizeable chunk who do. In 2024 the Total Retail spend in the UK was:

£517 billion

(which includes both online and bricks-and-mortar. Plus the essentials in everyday life. it is still a load of dosh)

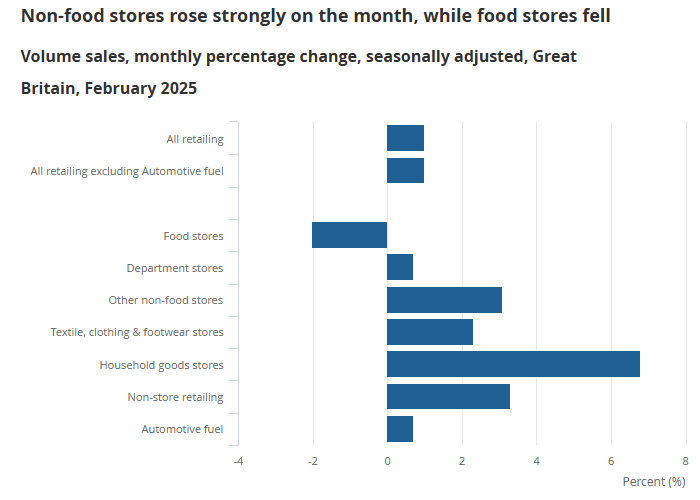

This graph show retail sales in the UK for February 2025. I think it is significant that the only sector to experience a fall is Food. But I don’t know what the significance is.

Office of National Statistics

Consumer spending trends to watch

Households are making strategic choices in 2025, with discretionary spending concentrated in key areas:

- Travel & leisure: 33% of consumers plan to prioritise experiences.

- Home furnishings: 28.6% of affluent households are investing in their living spaces.

- Tech & electronics: 25.1% of younger consumers are upgrading devices.

- Automotive: 22.5% of under-45s and affluent consumers are making vehicle-related purchases.

- Luxury goods: 18.4% of younger, high-income consumers are investing in aspirational brands.

Retail Economics

There is no quick fix to make your Retail operation Buzz. There never has been. You have to earn your place on the High Street. It does not owe you anything. The consumer still likes to go shopping. You just need to make sure that your store is one of those they want to shop in.

Stop Press:

Total UK footfall rose 7.2% during the four weeks from 6 April to 3 May, up from -5.4% the month prior, according to the British Retail Consortium (BRC).

High street footfall increased 5.3% over the period, rising from -4% in March, while retail park footfall jumped 7.5% from -1.2% the month before.

Shopping centre footfall was boosted 5.6% over the period, increasing from 5.8% in March.

Footfall rose year on year across England (6.7%), Scotland (6.9%), Wales (13.6%) and Northern Ireland (14.3%).