Ever since the human species started selling stuff, there has always been a New Kid. Today we would call them disruptors.

- A bloke on a horse (they would, invariably, have been male) would have replaced the bloke on foot walking from camp to camp flogging stuff to the camp dwellers. For horse insert donkey, cow, camel, goat or whatever was the local form of four legged transport

- Carts were added to help carry more stuff

- When the camps got bigger no doubt the local entrepreneurs would have built some sort of semi permanent stall

- Eventually permanent buildings ( A shop) would have been erected

- The next step ( I think) would have been a group of shops, selling the same stuff , owned by the same entrepreneurs having them located in different towns. Thinking about it this could have been the first disruptor in the retail market place. A shop liked by the consumer because they did not have to travel to other towns to buy these products and bought them at better prices because the entrepreneur paid less for them as they bought in bulk . The very same reasons other retailers would have hated them. Thereby disrupting the market as opposed to purely developing the market

- Department stores

- Mail order

- Chains of Department stores

- Supermarkets (disruptor)

- Huge supermarkets (disruptor)

- Discount stores (not sure about this one)

- Convenience stores

- Online shopping

- The market places eg eBay & Amazon etc (big disruptors) but very different animals

- Social media platforms ie Facebook, Instagram & Tik Tok, combined with the use of Influencers(disruptors)

For sometime now, Mr Bezos and his garage start up has been the scourge of many a retailer worldwide. At the same time it has also created many multi million dollar sellers .

Is there any other retail operator that make this claim? Apart from some of the world food franchises eg McDonalds and KFC et al, I doubt it . What is more, the majority of Amazon’s profits are made from its cloud computing operations. Such as hosting a big chunk of the U.K. government’s operations including that of HMRC . Yes that’s what you’re thinking, all my tax returns? It amazes that me that many still don’t realise this including a number of accountants I know. Yes, next time you post your Vat returns you will see them fly off to AWS cloud .

But this is not about Amazon, there is a new kid on the block . I believe this one is much more insidious.

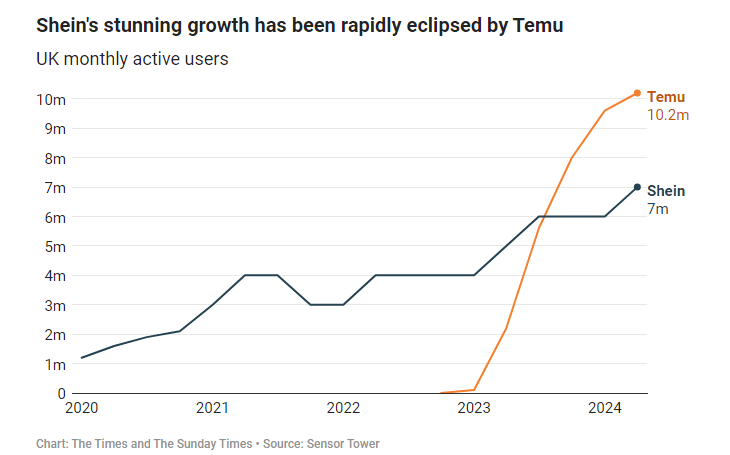

I posted about this particular beast in 2023, detailing its extraordinary growth. Temu is it’s name, disruption is it’s game.

Below is a chart, which represents its parent company Pinduoduo, rapid growth in the US.

It isn’t that by buying from Temu , you can seemingly refurbish a four bedroom house for £13.50. It isn’t what may actually turn up in your door step a few weeks later may not be quite exactly as the image you bought from. Neither is it that the quality of said goods might mean you have to refurbish your house again a month later . Nor is that the likelihood that any of these products meet any quality or safety standards. I see none of this as a problem as I feel the consumer worldwide is more canny than that. They will get over the novelty and quite literally use it as a giant novelty gift shop .

Most of us would think it would only be the Gen Z generation who were hooked by it . The stats below ( once again from the US) show the complete opposite.

This alternative Perfidious Albion goes much deeper. Before I go any further , I have waited a long time to use that phrase and I am not completely sure , I have got it right this time but look it up and hopefully you can see if I have.

1. They are amassing a huge amount of data

2. They are scraping the ocean floor of keywords relating to their product areas creating havoc on many online stores specialising in those products .

Amassing a load of data is no new thing. Amazon have been doing it for nearly thirty years. Temu have been doing it less than thirty months. We, sort of, let Amazon do it as they provide products the Consumer likes and wants and if the product is not right Amazon sorts it. Their focus has always been on the consumer . Consequently the consumer is very confident buying from Amazon. As far as the Temu’s of this world are concerned they just provide very cheap product and I don’t see that as a long term business model .So what is their plan….

I am none the wiser.

The keywords issue is having a big impact on online web shops. Within my own industry , I have stories where they have hijacked over 40% of the relevant key words. This has had an immediate impact on their business. If I type in google Party shops in Leicester (or any other town in the UK ) Temu will come up first or second. This, in itself, is not usual . But this has happened very quickly and is very disruptive.

There have been other disruptors in recent years such as Alibaba & Shein. Shein employs approximately fifteen people in the UK as of last September. They have also opened various pop up shops and acquired some brands such as Misguided. Yes they are very cheap but from subjective sources the quality is poor. In the US there is an 88% awareness of the brand but only just over 20% satisfaction rate (Statista.com) . But it is very clear as to what their mojo is. Cheap, throw away fashion. I am not sure we know what Temu’s is ?

In a slight aside Shein is looking for a listing either in New York or London, with a current valuation of approximately $60 Billion (down from $100 billion). Some financial journalists believe they are looking for a listing as soon as possible , whilst the valuation remains relatively high as they are being constantly being scrutinised for manipulation of EU & UK tax laws concerned with import duties, in addition to age old agreements on very favourable local shipping rates.

If a company fills a container with items, they can say they are all individual consignments and escape the duty — but in reality, it’s a container load of goods. It’s an abuse of the system,” Richard Allen, a campaigner with Retailers Against VAT Abuse Schemes (RAVAS).

Yet some observers wonder whether this also betrays a fear that stiff competition from its rival Temu, which has quickly aped aspects of Shein’s tax-lite model — as well as the prospect of regulatory crackdowns on fast fashion — will mean Shein’s stratospheric rise could soon level off. Sunday Times May 5th 2024

The tax laws referred to, refer to Temu as well . Low value single items (£135 in the UK) are treated as gifts with import duty .In many cases these single items are bundled together in a container still avoiding import duties but benefiting from lower courier rates and the benefiting from much lower local postal services.

This is a bit of an oversimplification but it illustrates of the nature of the beast we are all dealing with.

How we deal with it ? I don’t know. The French have decided to have a go

Brands that churn out cheap clothes and constantly change their styles face penalties of up to 50 per cent of the retail price in a move to offset their environmental impact.

Advertising is to be banned for fast fashion retailers, whose clothes are usually binned within months and end up in landfill. Unlike traditional brands which renew their collections four times a year, politicians claim that fast fashion brands offer thousands of new products every few days, causing pollution and encouraging their customers to keep spending. Sunday Times May 5th 2024.

As to how they can decide what are Cheap Clothes and how many new products are too many remains to be seen. However, going back to the start of the blog, there have always been disruptors and they will continue to appear and disrupt.

i suspect many thought about six years ago Jeff Bezos would be untouchable , or at least the retail version. Then came along 2 disruptors capturing billions of dollars of consumer spend from nowhere . Very soon there will be another. The extra ordinary thing is we don’t have any idea what format that new kid will take and who they will disrupt.